Capital

We help you grow by accessing growth capital from our banking partners. The process is super simple, and we check either your transactional data from our system or you can connect external bank accounts.

For Partners

Your customers need working capital to thrive, but 77% of SMBs are concerned about access to capital. See how Greathub helps you solve the biggest pain point for your customers.

Easy

Fast

Integrated

Expand your product suite to meet your customers’ needs.

Capital Metrics

Greathub seamless user experience and activation tools help our partners see engagement and utilization rates well above industry average, while our net promoter scores reflect highly satisfied customers.

More than three out of every five customers who start the sign-up process for Greathub Capital go on to order an advance, showing both the need for capital among SMBs and the effectiveness of Pipe’s product experience.

Pipe helps you grow with a variety of activation methods, with our email outreach alone yielding an average 9.4% activation rate within the first month for our vertical SaaS partners.

With an NPS well above the industry average, customers have shown they love Pipe’s fast, easy capital experience and would highly recommend it to others.

Growth platform

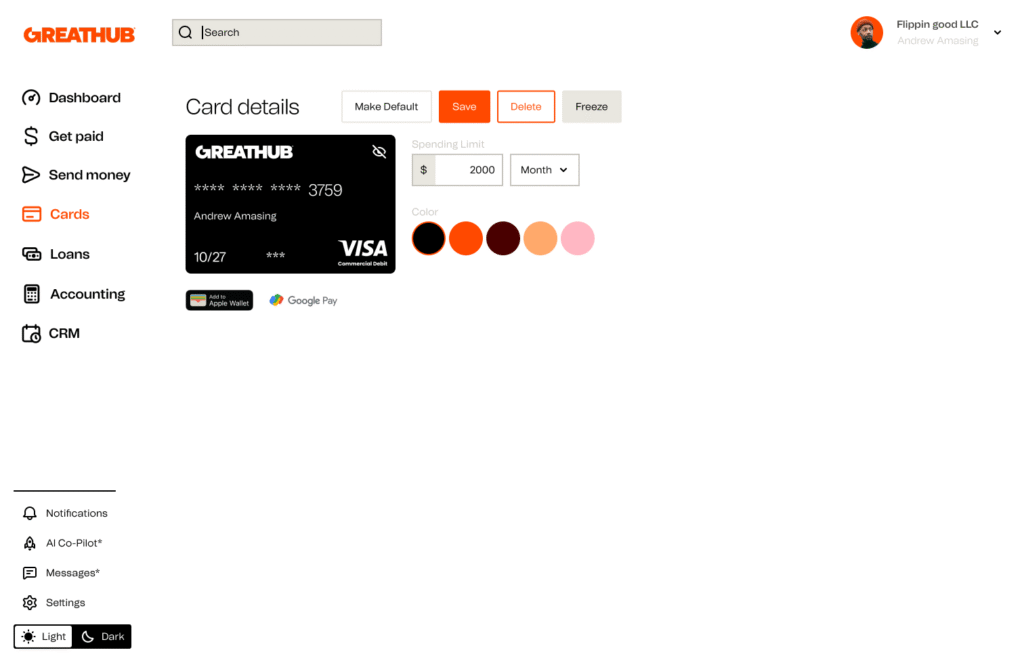

Greathub is a comprehensive solution for company expenses, with corporate cards linked to accounting and credit. Create an account and get started with a virtual card immediately.

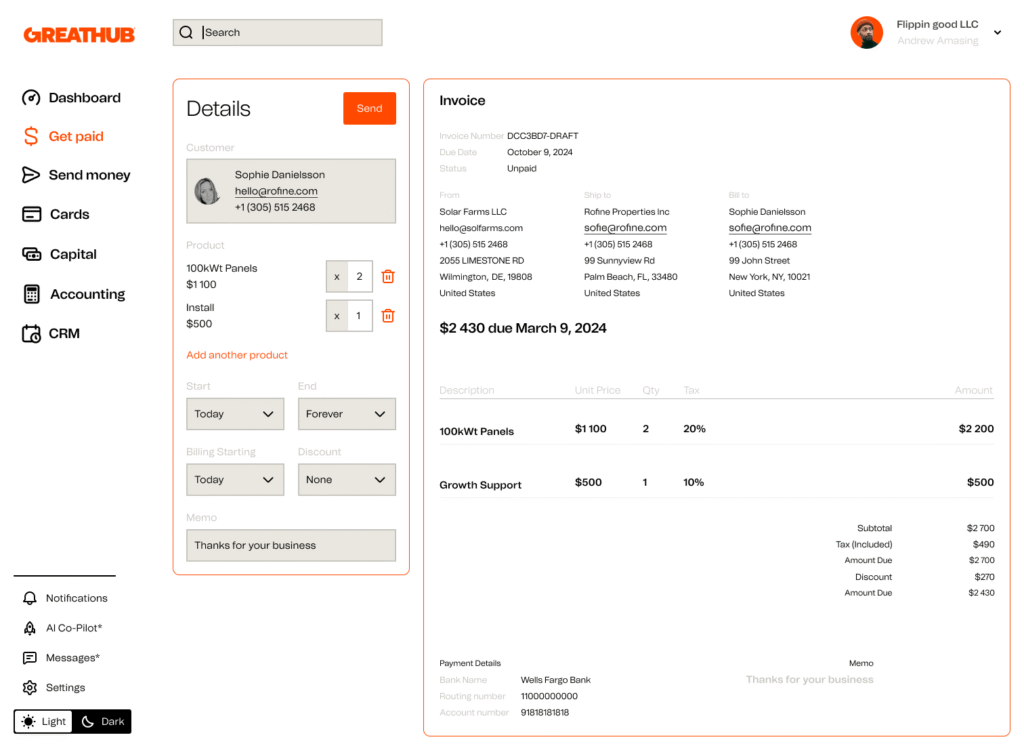

Streamline invoicing with smart automation. Generate, send, and track invoices in real time—fully synced with your accounting tools. Get paid faster, with zero hassle.

Better together

Greatgub is building a suite of embedded financial products to deliver seamless solutions for your customers

Greathub offers a Merchant Cash Advance, where a customer sells a portion of its future revenue for up-front capital. The MCA is paid as a percentage of revenue, allowing the customer to pay as they generate sales, without worrying about a fixed minimum payment when sales slow down.

Embedding a capital solution provides fast and easy capital access for customers on the same platform they use to run their business, improving retention and customer satisfaction, while also helping customers grow revenue and increase GPV.

Greathub has 2 integration options: Hosted, Embedded UI, ranging from a fast, no-code solution to a deep API integration for a fully customized customer journey.

Pipe gives you the option to fully white-label the capital offering so you can maintain your brand throughout the capital offering process.

Greathub has a full marketing, sales, and customer success team that can help you tailor your marketing strategies and service your customers end-to-end.

Revenue models vary but often involve a percentage of the funded amount or collected fees.

Greathub can help partners launch a capital offering in 2-4 weeks, depending on the integration option that is chosen.

Greathub Capital is currently available in the selected markets where we have banking partners.

Greathub is a technology provider, not a bank. Greathub partners with Stripe Payments Company for money transmission services and account services with funds held at Evolve Bank & Trust, Member FDIC. When you sign up for a Greathub account, you will also sign up for a Stripe Standard Connect Account. You may apply for various financial services within the platform and will need to agree to additional terms. Greathub Visa® Commercial Credit Cards are issued by Celtic Bank. Neither Greathub nor Stripe are FDIC-insured institutions. FDIC’s deposit insurance coverage only protects against the failure of an FDIC-insured depository institution. Stripe Treasury Accounts are eligible for FDIC pass-through deposit insurance if they meet certain requirements. The accounts are eligible only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. The FDIC insurance applies up to 250,000 USD per depositor, per financial institution, for deposits held in the same type of account. The information provided on this website is not intended to offer, and should not be relied upon as, tax advice. You can review all our legal agreements and disclosures here.