BUILD SOMETHING AWESOME

Get a Visa Business Debit Card to manage expenses, access business loans, and streamline operations—all in one place.

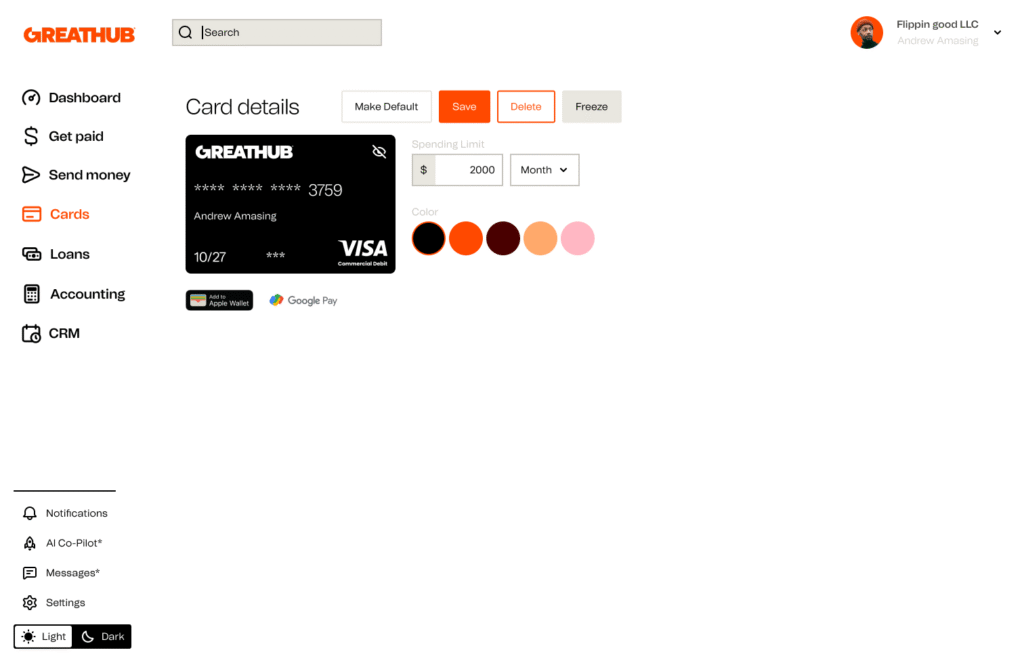

Greathub is a comprehensive solution for company expenses, with corporate cards linked to accounting and credit. Create an account and get started with a virtual card immediately.

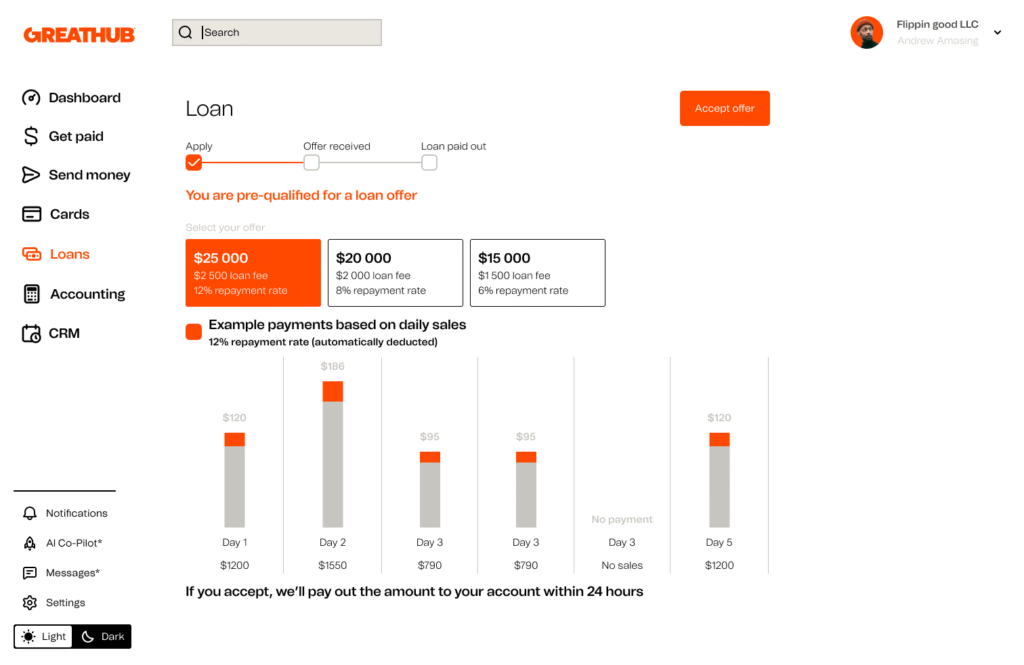

Access growth capital super fast and super easy. Sync your existing bank accounts and get an offer the same day from one of our banking partners.

Featured In

Expert Insights

We are not a vendor, instead, we position ourselves as a partner for growth.

Unlocking financial data isn’t just for big companies. No matter your size, it can be your most powerful growth tool.

Embedded finance isn’t just a feature—it’s a strategy. When you bring financial services into your product, you’re not just increasing revenue, you’re becoming essential to your customers’ daily operations.

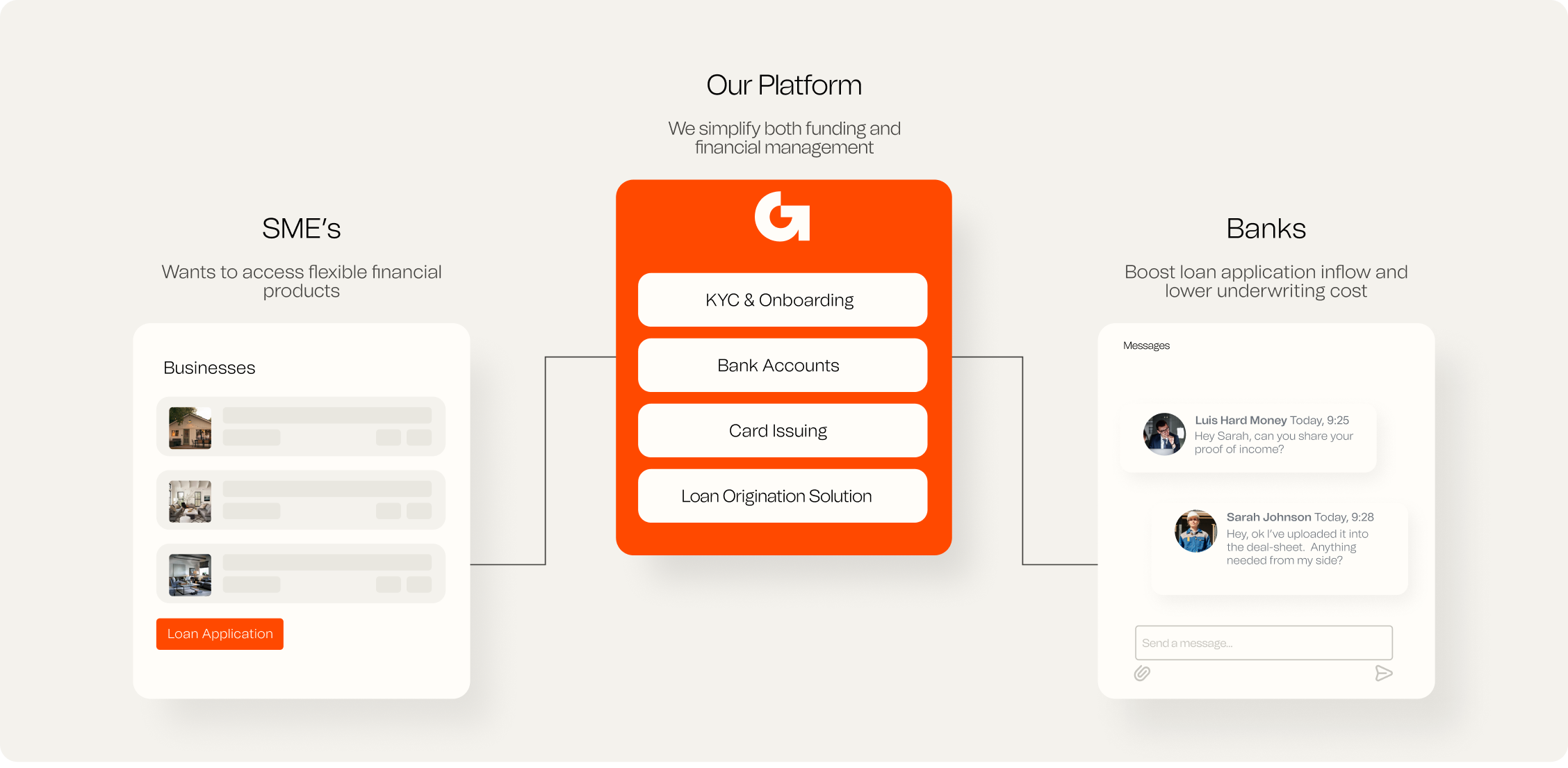

For Partners

Running an SME is hard. Financial tools like acquiring, card issuing, and loans are often pieced together from multiple providers. Add invoicing and accounting, and it becomes yet another layer of complexity. With Greathub, it’s all in one place—seamlessly integrated to any other tool you are already using.

Easy

Fast

Integrated

Expand your product suite to meet your customers’ needs.

Growth

Greathub is a technology provider, not a bank. Greathub partners with Stripe Payments Company for money transmission services and account services with funds held at Evolve Bank & Trust, Member FDIC. When you sign up for a Greathub account, you will also sign up for a Stripe Standard Connect Account. You may apply for various financial services within the platform and will need to agree to additional terms. Greathub Visa® Commercial Credit Cards are issued by Celtic Bank. Neither Greathub nor Stripe are FDIC-insured institutions. FDIC’s deposit insurance coverage only protects against the failure of an FDIC-insured depository institution. Stripe Treasury Accounts are eligible for FDIC pass-through deposit insurance if they meet certain requirements. The accounts are eligible only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. The FDIC insurance applies up to 250,000 USD per depositor, per financial institution, for deposits held in the same type of account. The information provided on this website is not intended to offer, and should not be relied upon as, tax advice. You can review all our legal agreements and disclosures here.