Quick Answers

FILTER BY TOPIC

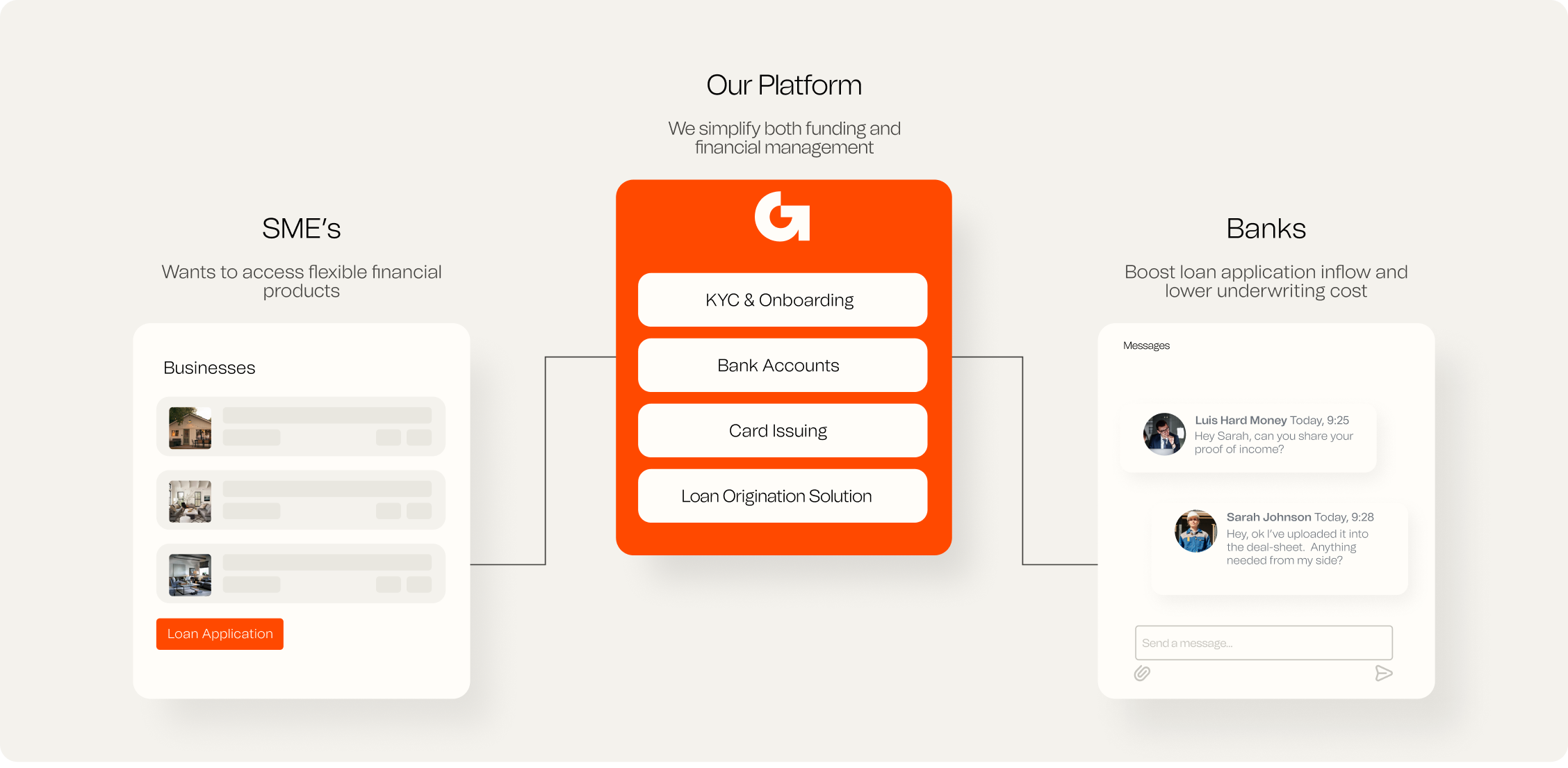

Greathub delivers capital, card issuing, and other financial tools within the platforms businesses already use—helping them grow faster, smarter, and on their own terms.

With Greathub’s embedded, software platforms can offer seamless access to financial services. Greathub empowers your customers to unlock capital based on the real-time health of their business. We provide the tech, so your business can issue the loans. Low risk and much faster than your current infrastructure. Our underwriting taps into live revenue data to deliver fast, fair financing. Once approved, customers can draw what they need and repay flexibly as a percentage of their revenue.”

From banks to telcos, Greathub helps platforms fuel small business growth. Get in touch to explore how we can work together.

We take a holistic view of your customers by analyzing both revenue and expenses from external bank data, connected via Open Banking platforms. Our algorithm assesses the overall health of their business—factoring in historical performance, available public data, and AI-driven projections of future revenue.

Offers are available for a limited time—typically 30 days—and customers are automatically reassessed for new offers as long as their operating account remains connected and they continue to meet eligibility criteria.

Your customers pay a single flat fee for access to capital—repaid gradually as a percentage of their future revenue. There’s no compounding interest, no personal collateral required, and no penalties if sales slow down. Unlike traditional lenders, we don’t impose monthly minimum payments, so businesses aren’t locked into burdensome obligations during tough times.

The fee is tailored to each business, based on factors like financial health, projected revenue, and sales volume. For example, a 10% fee on a $50,000 advance means a total repayment of $55,000.

Our pricing is simple, transparent, and predictable—so your customers always know what to expect.

There are many advantages to working with us. Below are some key benefits our clients have experienced:

a. Effortless setup

We offer off-the-shelf APIs that can be embedded into your credit origination process—or we can manage the entire process for you. You simply assess and decide whether to issue the loan; we handle the rest—quickly and smoothly.

b. Revenue-based repayments

Payments adjust with business performance. Strong month? Pay more. Slower month? Pay less. No fixed monthly costs, ever.

c. No personal risk

There are no personal guarantees or covenants—so business owners can access capital without putting their personal assets at risk.

d. Same-day funding

Once you—or the bank of record—approve the payment, funds are sent the same business day, often arriving within hours depending on the bank.

e. Human support, start to finish

Our experienced Revenue Managers provide end-to-end support—from onboarding to issue resolution.

Once customers are approved and their payment setup is complete, funds are sent the same business day to their business account in their organization of choice. This can be a Wallet, bank account, Depending on the transfer method and the receiving bank’s deposit policies, the capital can arrive within just a few hours.

In general, no—Greathub does not require financial regulation because it acts solely as a software vendor, not a loan originator or lender. We provide the technology that enables platforms to offer credit products, but we do not underwrite, fund, or service loans ourselves.

That said, regulatory requirements may vary depending on your location and the jurisdictions where our partners operate. If you’re unsure about your specific case, we recommend reaching out to our team—we’re happy to help clarify.

Greatweek adapts to a wide range of lending flows—from unsecured to secured, and from consumer to SME lending.

Our main focus is Merchant Cash Advance (MCA), where a business receives upfront capital in exchange for a portion of its future revenue. Repayments are made as a percentage of sales, so customers pay more when business is strong and less when it’s slow—without the pressure of fixed monthly payments.

Our Embedding capital solutions directly into your platform gives customers fast, seamless access to funding—right where they run their business.

This not only boosts customer satisfaction and retention, but also helps them grow revenue and increase gross payment volume (GPV).

We offer two integration options:

Hosted: Use our user interface with your own brand, with your decision-making process. It’s quick to launch and requires no development work on your side.

Embedded API: Integrate our full process and infrastructure directly into your app for a fully customized customer journey and seamless user experience.

Pipe gives you the option to fully white-label the capital offering so you can maintain your brand throughout the capital offering process.

Revenue models vary but often involve a percentage of the funded amount or collected fees.

With Greathub, you can launch a capital offering in 2-4 weeks, depending on the integration option that is chosen.

Greathub Capital is available wherever we have banking partners—currently in over 120 countries. Contact us to learn more.”

Embedding a card issuing solution lets you launch a custom card program quickly—while simplifying risk, compliance, fraud, and underwriting.

It also gives your customers more flexible spending options and gives you a complete view of their business activity.

Greathub Issuing Platform is a white-label business charge card that partners can embed into their own platforms. We offer three options: Credit, Debit, and Prepaid—depending on your preferences and the capabilities of your banking partner.

o tailor the best offers for your customers, Greathub will initiate a data-sharing process. This includes accessing key information like historical transactions, payment behavior, and other custom fields. We use Open Banking and other publicly available data sources to support this underwriting process.

Cards are issued by our partner banks but carry your brand. Greathub simply provides the software behind it.

The Greatweek uses a simple 3-step revenue share model, where both the interchange percentage and fixed fees are split between the sponsor bank, platform partner, and Greathub.

Yes, you can fully brand the card—from logo to design—ensuring a seamless experience under your name. While the issuing partner’s name will appear on the card as required, the rest of the experience is entirely white-labeled. Our team is here to support you with the design and branding process.

Yes, Greathub Business Cards are accepted wherever Visa® cards are accepted.

Yes, mobile wallets are fully supported through Greathub Cards.

We offer two integration options:

Hosted: Use our user interface with your own brand, with your decision-making process. It’s quick to launch and requires no development work on your side.

Embedded API: Integrate our full process and infrastructure directly into your app for a fully customized customer journey and seamless user experience.

This depends on the integration. We’ve seen partners complete our embedded UI integration in as little as two weeks.

Yes we allow you to fully customize our products to match your platform’s brand, design systems, and UI elements.

Greathub will request a data sharing process to underwrite your customers, including details such as historical transaction data, payment amounts, and other custom fields to help us create the best offers for your customers.

This depends on the integration. We’ve seen an integration completed in as little as two engineering weeks. Greathubs teams are also at your disposal to streamline the integration process.

There are no credit checks, lengthy paperwork, or personal guarantees.

Connect: Connect your revenue and bank information through our secure integrations. You will be able to quickly find out how much capital you may be eligible for.

Verify details: Provide business details, a chosen business representative, and information on the business owners to verify your account.

For certain situations, an FBO only account is needed. Set up your Advance Payments Account (US Only)*: Your ticket to effortless payments.

That’s it– your capital will be on the way!

Greathub receives your revenue data from your platform. We also ask that you connect your business bank account so that you can receive your funds.

You can choose to advance as much or as little of your offer as you want until the offer expires. This makes it easy to just use what you need, when you need it, and only pay for the amount that you advance.

Contact us

Greathub is a technology provider, not a bank. Greathub partners with Stripe Payments Company for money transmission services and account services with funds held at Evolve Bank & Trust, Member FDIC. When you sign up for a Greathub account, you will also sign up for a Stripe Standard Connect Account. You may apply for various financial services within the platform and will need to agree to additional terms. Greathub Visa® Commercial Credit Cards are issued by Celtic Bank. Neither Greathub nor Stripe are FDIC-insured institutions. FDIC’s deposit insurance coverage only protects against the failure of an FDIC-insured depository institution. Stripe Treasury Accounts are eligible for FDIC pass-through deposit insurance if they meet certain requirements. The accounts are eligible only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. The FDIC insurance applies up to 250,000 USD per depositor, per financial institution, for deposits held in the same type of account. The information provided on this website is not intended to offer, and should not be relied upon as, tax advice. You can review all our legal agreements and disclosures here.