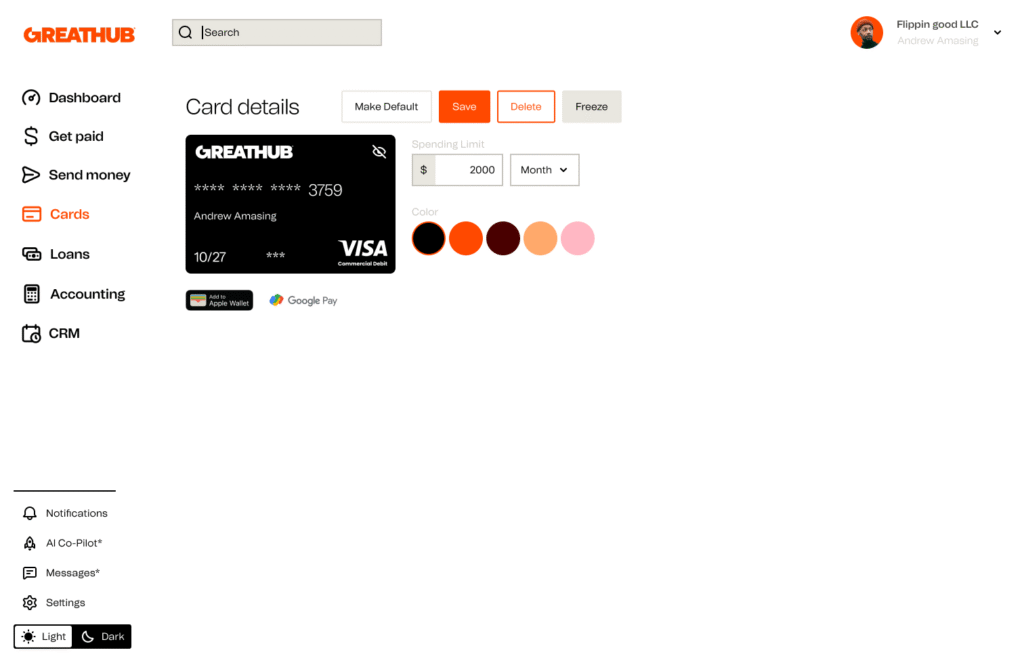

Cards

Issue cards to yourself and to your staff for day-to-day spending. Virtual or Physical – your choice.

A better way to simplify spending and manage business expenses

A frictionless card issuing, embedded natively in your platform where you have your accounts, invoices and accounting.

Signup in minutes

Issue cards in seconds

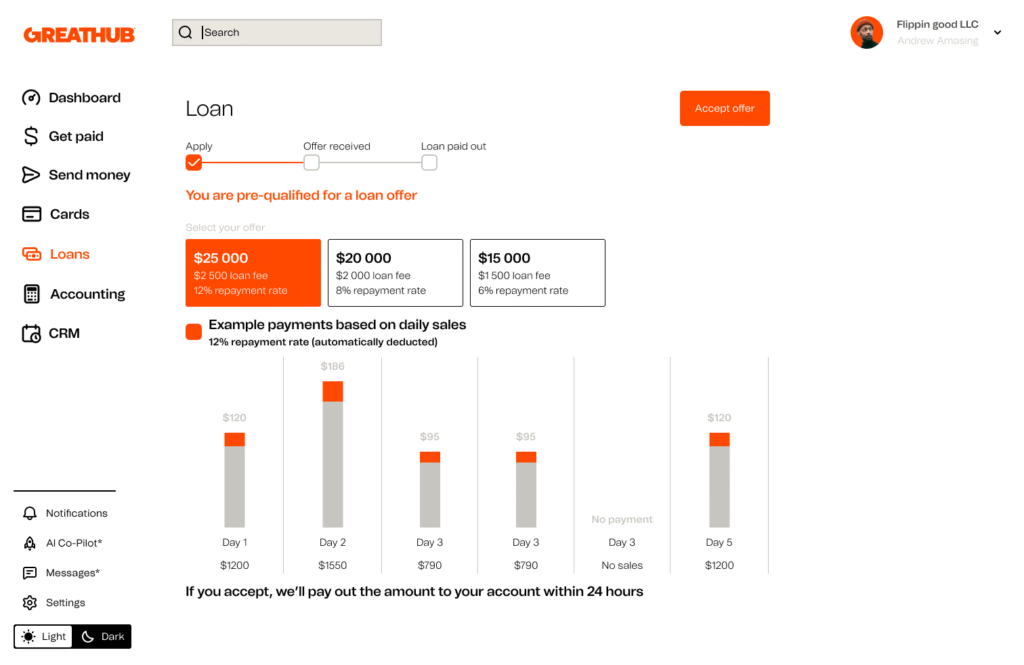

Apply for loan and get access to funds in days

We work with the leading banks to provide you solutions that help you grow.

We can integrate to any tools you already love and use.

We help you grow by giving you access to financial tools you need.

Get your business to be innovative with the latest tools on the market.

Outcompete, the competition

Don’t pay for anything upfront. Access more tools as you grow.

Give yourself more flexibility with cash flow while handling day-to-day business expenses, with additional benefits including:

We are your growth partner

Access growth capital super fast and super easy. Sync your existing bank accounts and get an offer the same day from one of our banking partners.

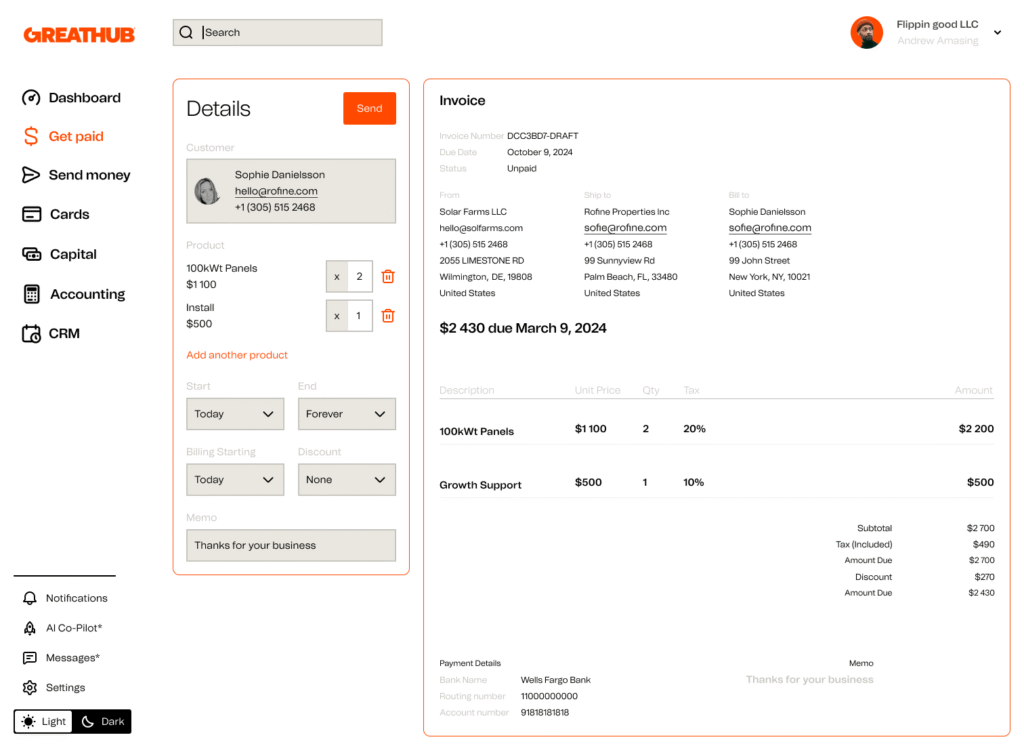

Streamline invoicing with smart automation. Generate, send, and track invoices in real time—fully synced with your accounting tools. Get paid faster, with zero hassle.

Greathub Business Card is a business card for partners to embed within their platform. Unlike traditional card issuers, Greathub uses a revenue-based underwriting model to determine credit limits. The Greathub Business Card is a pay-in-full charge card with 15 days to pay after the end of the billing cycle. Greathub Business Card is currently only available in the US.

Greathub partner banks issue the cards and provides the capital and takes on the underwriting risk. Your platform is not financially responsible for your business’s transactions.

Greathub will request a data sharing process to underwrite your customers, including details such as historical transaction data, payment amounts, and other custom fields to help us create the best offers for your customers.

Greathub Business Cards are issued by various bank partners, depending on the territory it operates in.

Greathub Business Card credit limits can vary between 15-30% of your customer’s monthly revenue.

Greathub Business Card is free to use for partners and their merchants. Additionally, Greathub offers a share of the commercial credit interchange with our partners that they can choose to share back with their merchants as cash back.

Greathub gives you the option to fully white-label the card offering so you can maintain your brand throughout the card offering process. We will be happy to support you in the design process.

Yes, Greathub Business Cards are accepted wherever Visa® cards are accepted.

Yes, mobile wallets are fully supported through Greathub Business Card.

Greathub is a technology provider, not a bank. Greathub partners with Stripe Payments Company for money transmission services and account services with funds held at Evolve Bank & Trust, Member FDIC. When you sign up for a Greathub account, you will also sign up for a Stripe Standard Connect Account. You may apply for various financial services within the platform and will need to agree to additional terms. Greathub Visa® Commercial Credit Cards are issued by Celtic Bank. Neither Greathub nor Stripe are FDIC-insured institutions. FDIC’s deposit insurance coverage only protects against the failure of an FDIC-insured depository institution. Stripe Treasury Accounts are eligible for FDIC pass-through deposit insurance if they meet certain requirements. The accounts are eligible only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. The FDIC insurance applies up to 250,000 USD per depositor, per financial institution, for deposits held in the same type of account. The information provided on this website is not intended to offer, and should not be relied upon as, tax advice. You can review all our legal agreements and disclosures here.